QUANTVESTOR

GLOBAL TRADING INDICATORS

QUANTVESTOR

INFORMATION AT gtindicators@gmail.com

Results and strategy available in Bloomberg through the PORT function

Trade with the algorithm based on Global Trading Indicators technical indicators:

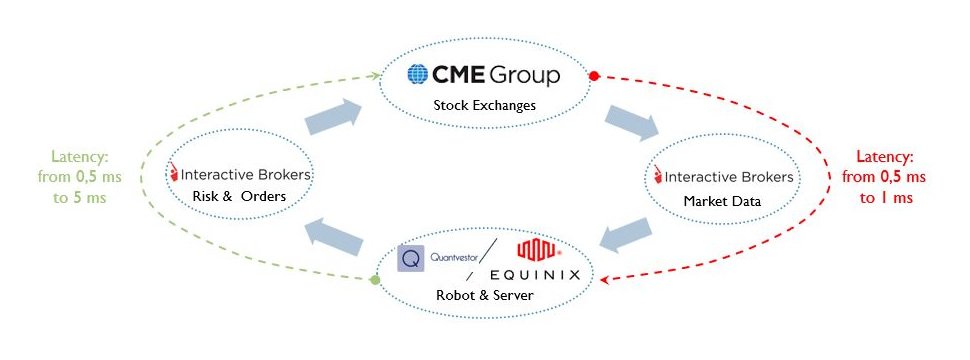

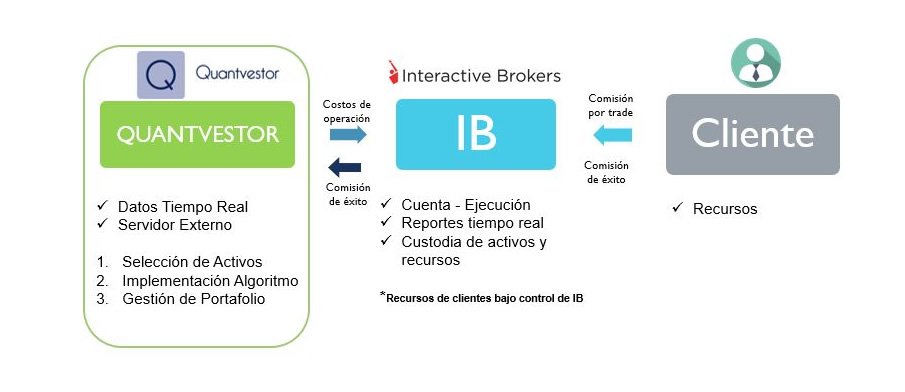

It is a form of operation in financial markets associated with quantitative trading, using 100% emotion-free automated procedures, and algorithms to execute buys and sells.

Benefits

Low costs

Operational efficiency

Risk diversification

Monitors close to 1,000 assets simultaneously in the equity and ETF’s markets

Uses 3 artificial intelligence engines to analyze fundamental, technical and news of the markets operated in the United States stock markets

Advantage

Trading in algorithmic trading will allow:

Generate Alpha

Manage own assets for speculative purposes

Create third-party portfolios for speculative purposes

Create structured notes with guaranteed capital and performance linked to algorithm performance

Create QUANTITATIVE investment funds for speculative purposes that complement investment alternatives

Manage a percentage of investment funds.

Other information

Links of our social networks

https://www.linkedin.com/company/gtindicators