EXCLUSIVE TECHNICAL INDICATORS

Take advantage over other traders thanks to these exclusive technical indicators

Global Trading Indicators is a powerful tool based on volatility analysis that can be used in any TIME-FRAME (minutes, days, etc..)

HOW OUR INDICATORS WORK

One of the most difficult steps in making an investment decision is after a big movement in the market, which is called the “moment of explosion”.

POWERFUL AND EASY TO USE INDICATORS

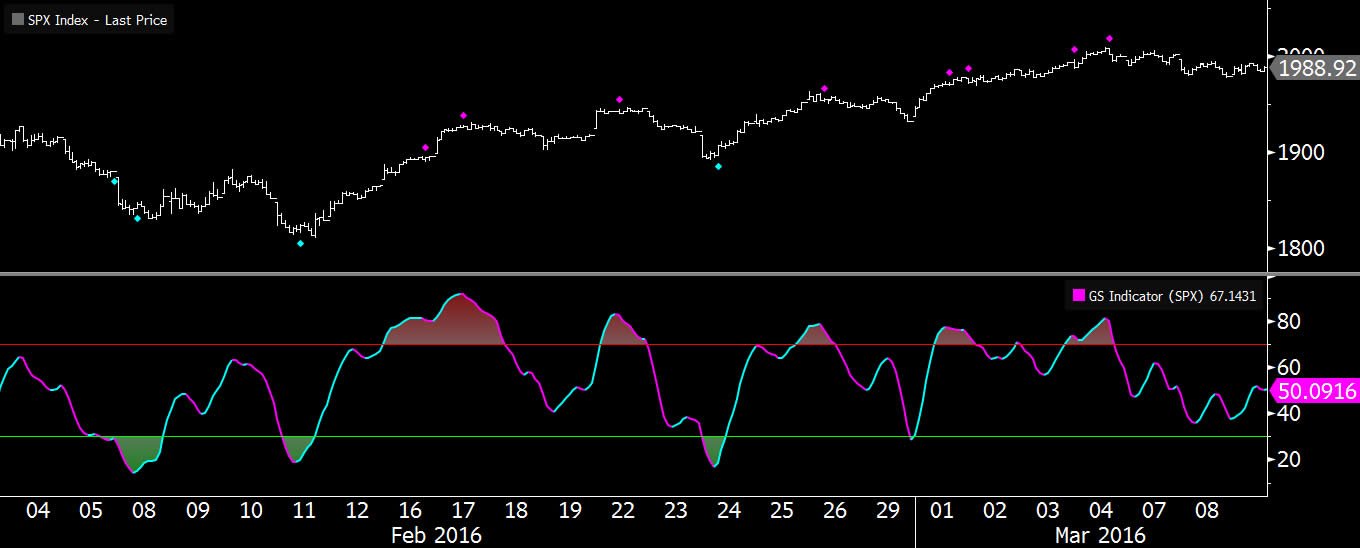

We currently have 11 indicators, which are based on our theory called (VERA) Volatility Explosion Relatively Adjusted designed to predict the moment in which the volatility explosion will occur and thus obtain a first warning signal that generates a new investment strategy.

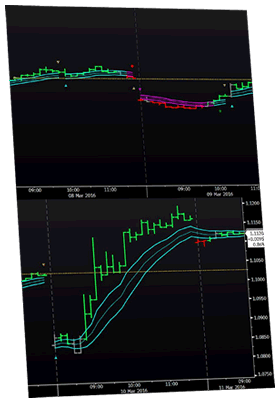

Color (Blue) bullish trend and Color (Magenta) bearish trend.

Vera Average: Market price of the reference area

Upper limit: upper band used as trailing stop for short positions

Lower limit: low band used as trailing stop for long positions

Red and green arrows – the entry point for long and short positions

Orange Triangles: ALERA VERA can be used in two ways:

- Profit-taking (usually overnight position)

- Volatility exposure alert where the stop or trailing stop must be established

Blue or magenta triangles: serve as a sign of re-entry into positions and/or confirmation of a trend

OHLC bars, Red (bearish), Green (bullish), Gray (Neutral)

Line (blue): bullish stops area

Line (magenta): area of stops for a downtrend

Grayline (opening): entrance to the risk area

Green arrows: the signal of trend change (bullish or bearish)

Pink circle (possible exhaustion of the uptrend)

Olive green circle (possible exhaustion of the downtrend), can be used in two ways:

- As a profit-taking area (usually overnight position)

- As an alert zone where you can set the stop or trailing stop

The lime or red arrows serve as an indicator for the re-entry of positions and / or to confirm the trend.

OHLC bars, red (bearish), green (bullish), gray (neutral)

BLOG

GTI Indicators news in the media

Bitcoin techniques suggest the monster rally went too far, too fast

Bitcoin’s trading around $9,000 once again but technical indicators show it may have gone up too far, too fast. Based…

» MORE INFORMATION

Bitcoin plummets in wake of Chinese New Year slowdown warning

Bitcoin traders appear to be heeding a warning of a demand slowdown ahead of China’s lunar New Year. The largest…

» MORE INFORMATION

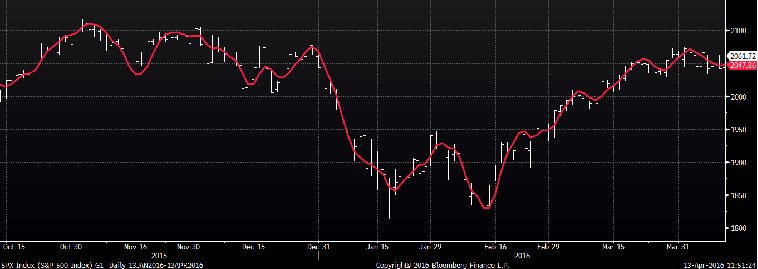

Colombian launches application in Bloomberg

"The indicators are based on a developed theory of their own called the Relatively Adjusted Volatility Explosion (V.E.R.A.)". See News…

» MORE INFORMATION